If there is a decline in the net income component percentage from the previous year to the current year, it means the company was not as profitable in the current year and may have even had a net loss. On the other hand, if there is an increase in the net income component percentage from the previous year to the current year, it means the company’s net profits were more in the current year than the previous one. According to its cash flow statement, the net income of company A equaled $155,000. Company B earned a net income of $20,000, while Company C generated a loss of $-75,000. Note how easy it is to merge this information into one comparable indicator. Companies prefer to report gross profits because it gives a better indication of the company’s overall profitability.

- Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns.

- Moreover, an entity can temporarily improve its net profit ratio by delaying such expenditures which don’t have a significant immediate impact on profitability.

- Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

- Net profit is calculated as revenues less all expenses, which include cost of sales, salaries, interest on loans taken for business operations, rent paid for premises used in business operations etc.

- Operating income (EBIT) represents the point on the income statement where all operating costs have been deducted.

- For example, a company can have $10 million in sales but $12 million in revenue if nonoperating income totals $2 million.

Would you prefer to work with a financial professional remotely or in-person?

Consequently, the desirable values of this indicator are entirely relative. It’s also a good idea to compare profitability measures to liquidity indicators, such as the current ratio, to get a broader picture of a company’s financial stance. Instead of getting carried away with big numbers and gross profits, a simple calculation to find a company’s net profit margin can give you a more realistic picture of how a company is doing.

Net profit (NP) ratio

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. If we take gross profit as a percentage of sales (gross profit ratio) and then relate it to net profit as a percentage of sales (net profit ratio), we can evaluate the efficacy of a company’s pricing policy. The most common and widely used type of profit margin is net profit margin, which accounts for all of a company’s costs, both direct and indirect. The number has become an integral part of equity valuations in the primary market for initial public offerings (IPOs). Enterprises operating multiple business divisions, product lines, stores, or facilities that are spread out geographically may use profit margins to assess the performance of each unit and compare them against one another. For example, if you own a restaurant, this would include all ingredients, packaging, and other items sold to customers.

How much are you saving for retirement each month?

Any money coming in from outside of core business operations (selling products and services) is considered nonoperating income and is included in revenue but not sales. Companies that have higher degrees of specialisation can afford to have a lower gross profit margin because they are able to produce more products at a lower cost. Software companies, for instance, often have high gross margins because they can create a single product and then sell it to a larger market.

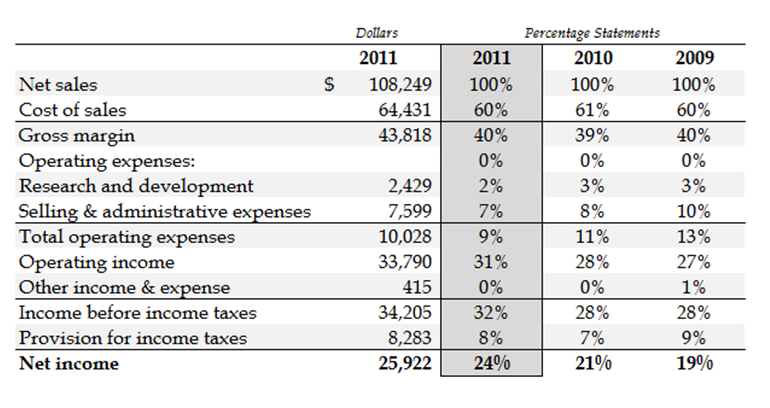

Ideally, investors want to see a track record of expanding margins, meaning that the net profit margin is rising over time. The 25.9% net profit margin of Apple (AAPL)—which is the company’s standardized net income—can now be compared to its historical periods or to its comparable peers to analyze its current profitability. A company’s net profits in a given period can be divided by the amount of revenue generated to calculate the net profit margin, a frequently used profitability metric among equity shareholders. Net Income is a measure of accounting profitability, or the residual, after-tax profit of a company once all operating and non-operating costs are deducted. In this income statement, you can see that Company A reports $46 billion in sales and that the cost of producing that revenue totaled $17.9 billion, resulting in a gross profit of $28.1 billion. To get from sales revenue to net income, you first subtract the cost of goods sold from sales revenue to find gross profit.

What Is Net Profit Margin? Definition, Formula, And Examples

The net profit margin calculator allows you to work out a simple and intuitive measure of a company’s profitability in relation to its total revenues. It’s a straightforward way to determine how large the profit generated by a single dollar of sales is. According to Investor.gov, net income refers to your company’s profits after all its taxes and other expenses, including production costs, have been deducted from its revenue. If you look at an income statement template, you can find it at the bottom as the value in the bottom line. Gross profit measures a company’s total sales revenue minus the total cost of goods sold (or services performed).

It’s the least investors and entrepreneurs can do to learn about profitability. However, if you’d rather not calculate the financial metrics yourself, investment portfolio management software can help. There are many different metrics that analysts and investors can use to help them determine whether a company is financially sound. One of these is the profit margin, which measures big tax changes for musicians in 2018 the company’s profit as a percentage of its sales. In simple terms, a company’s profit margin is the total number of cents per dollar that a company receives from a sale that it can keep as a profit. Profitability ratios are often the first thing investors look at before investing in a company and the most popular and widely watched of them all are profit margins.

Net profit (NP) ratio can be a useful tool for measuring the overall profitability and operating performance of a commercial entity. A high ratio number indicates an efficient management of operational affairs of the entity and a low number might indicate otherwise. According to NYU Stern School of Business, the companies in the U.S. with the highest profit margins, as of Jan. 2024, are banks, oil and gas producers and explorers, and tobacco companies. The ratio of net income to sales essentially expresses the overall cost and price effectiveness of the business. This ratio provides an indication of the buffer available in case of higher costs or lower sales in the future.