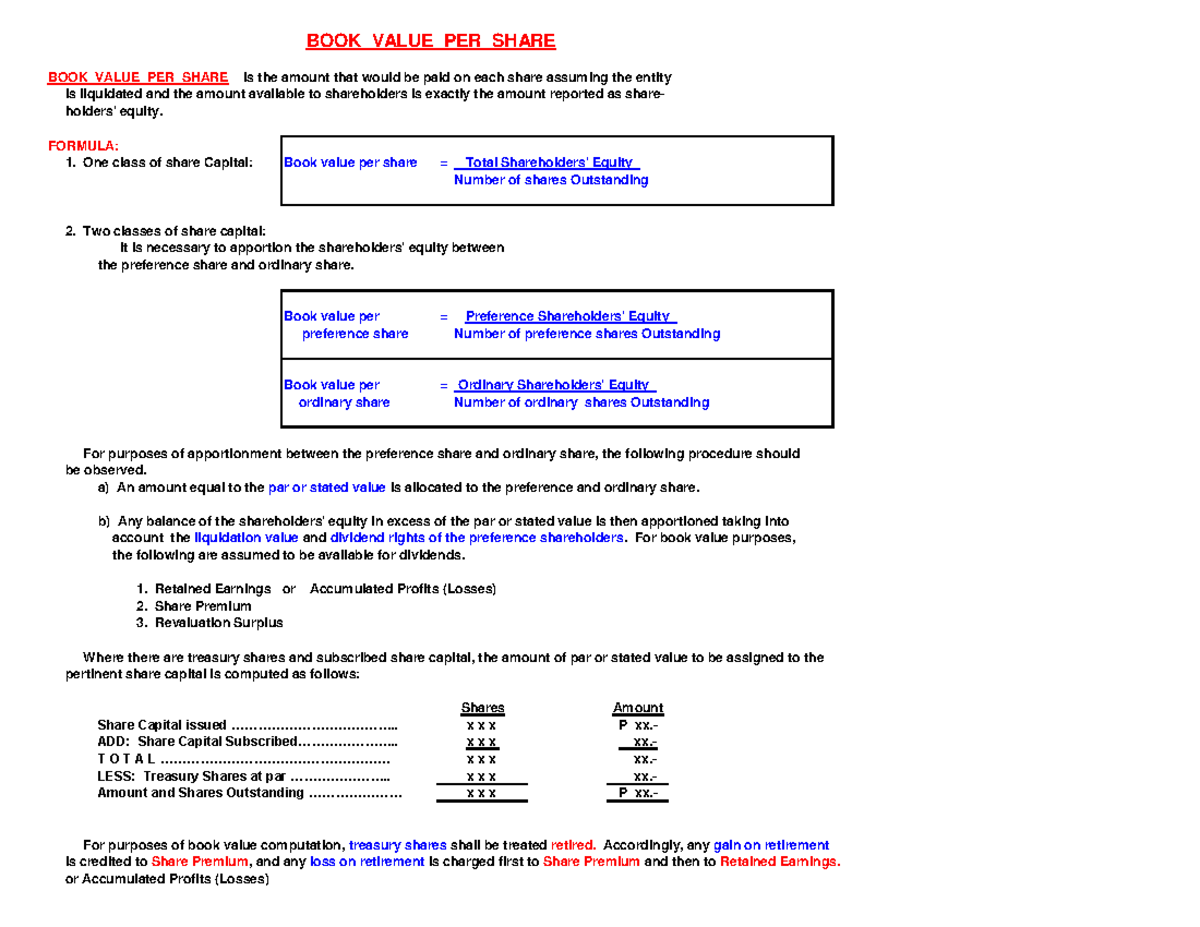

It also accounts for all of the company’s liabilities, such as debt or tax burdens. To get the book value, you must subtract all those liabilities from the company’s total assets. Book Value per Share (BVPS) is the ratio of a company’s equity available to common shareholders to the number of outstanding company shares. This ratio calculates the minimum value of a company’s equity and determines a firm’s book value, or Net Asset Value (NAV), on a per-share basis. In other words, it defines the accounting value (i.e. book value) of a share of a company’s publicly-traded stock.

What Is Price Per Book Value?

A price-to-book ratio under 1.0 typically indicates an undervalued stock, although some value investors may set different thresholds such as less than 3.0. BVPS is more relevant for asset-heavy companies, such as manufacturing firms, where physical assets constitute a significant portion of the balance sheet. An asset’s book value is calculated by subtracting depreciation from the purchase value of an asset.

Join Over Half a Million Premium Members Receiving…

- Ultimately, accountants must come up with a way of consistently valuing intangibles to keep book value up to date.

- For example, if a company has total common equity of $1,000,000 and 1,000,000 shares outstanding, then its book value per share would be $1.

- Market demand may increase the stock price, which results in a large divergence between the market and book values per share.

- In those cases, the market sees no reason to value a company differently from its assets.

- Whereas some price models and fundamental analyses are complex, calculating book value per share is fairly straightforward.

For the purpose of disclosure, companies break these three elements into more refined figures for investors to examine. Investors can calculate valuation ratios 4 steps to freelance full from these to make it easier to compare companies. Among these, the book value and the price-to-book ratio (P/B ratio) are staples for value investors.

Book Value vs. Market Value: An Overview

The Price-to-Book Ratio maintains the connection between the net value of a company’s assets as shown on the balance sheet and the entire value of its outstanding shares. An even better approach is to assess a company’s tangible book value per share (TBVPS). Tangible book value is the same thing as book value except it excludes the value of intangible assets. Intangible assets, such as goodwill, are assets that you can’t see or touch. Intangible assets have value, just not in the same way that tangible assets do; you cannot easily liquidate them. By calculating tangible book value we might get a step closer to the baseline value of the company.

Investors using book value as an evaluative metric are looking at how far above or below the current market value per share it is. BVPS is a useful benchmark for determining whether a stock is undervalued or overvalued by the market, and by how much. This is usually accomplished through comparative metrics like book-to-market ratio.

A company’s stock buybacks decrease the book value and total common share count. Stock repurchases occur at current stock prices, which can result in a significant reduction in a company’s book value per common share. The book value per share (BVPS) metric helps investors gauge whether a stock price is undervalued by comparing it to the firm’s market value per share. BVPS is what shareholders receive if the firm is liquidated, all tangible assets are sold, and all liabilities are paid. The market value per share is a company’s current stock price, and it reflects a value that market participants are willing to pay for its common share.

It’s a simple way to compare the value of a company’s net assets to the number of shares that are outstanding. But be sure to remember that the book value per share is not the only metric that you should consider when making an investment decision. BVPS is significant for investors because it offers a snapshot of a company’s net asset value per share. By analyzing BVPS, investors can gain insights into a company’s financial health and intrinsic value, aiding in the assessment of whether a stock is over or undervalued. On the other hand, investors and traders are more interested in buying or selling a stock at a fair price. When used together, market value and book value can help investors determine whether a stock is fairly valued, overvalued, or undervalued.

Making Calculations Practical Now it’s time to use the calculation for something. The first thing one might do is compare the price/BVPS number to the historic trend. In this case, the company’s price/BVPS multiple seems to have been sliding for several years. Secondly, one will want to compare Walmart’s price/BVPS to similar companies. In this case, the stock seems to trade at a multiple that is roughly in line with its peers. If the company is going through a period of cyclical losses, it may not have positive trailing earnings or operating cash flows.